Instant payday loans rescue employees from harassment and financial stringency. By the end of the month, maybe you have to struggle due to the lack of fund to buy medications or pay the utility bills. It is not a big amount which you require. Instead of borrowing the amount from friends or relatives, kindly depend on payday loan providers who must help you to overtake harsh situation eventually. However there must be pros and cons of the same day or advanced cash options. Before applying for the pay day loan, you must conduct surveys and do comparison research. There is no manual paperwork to take payday loans. You are not obliged to submit site map of your home or deposit the fund for security.

Who Is Eligible for Payday Loan?

Certainly, payday loans are not suitable to all people. It is a faster loan approval system to give financial support to people who have monthly income. Officially, applicants must have stable jobs with good credit scores. They have to clear payday loans on time.

Unemployed youths, oldies and housewives are not allowed to have payday loans in case they are not employed by companies.

Pros of Getting Payday Loans

Payday loans facilitate employees to arrange fund within short time. It is a quick financial backup to a victim who has no other option. This same day payment stops harassments and humiliation. Therefore, people like to search for the top companies like alfalaan.dk which are ready to offer payday loans at low interest rates.

Do you need to mortgage your house or real estate property? It is not a secured loan, option but it is an attractive short term loan without any collateral or home mortgage. On next pay day you have to clear loan amount plus interest rates calculated by the money lender. If you fail it will be adjusted to the upcoming payday. Therefore, certainly it is not difficult for a person to bear the expenses.

Fast Same Day Loan Offer

Online same day loan offer is very glossy to entice employees. After simple navigation to choose the best financial company to have advanced cash, customers need to do hassle free formalities. They have to fill up the online payday loan forms giving detailed information including name, street address, monthly income update, pay slips copies, phone number and email address as well.

There are different slabs for candidates to ask for payday loan amount. Maximum $700 is offered to an applicant after successful application. That means, it is a great option to make you happy in the long run. Within 24 hours, your payday loan amount will be directly credited with your bank account. Therefore you have to mention current bank details to support the instant payday loan transaction. Check the interest rates, APR percentage and other formalities to have the complete assurance to get back readymade cash. Companies will deduct the required amount after the next payday.

However, if any borrower is not able to clear the whole amount, he can negotiate with the money lender. He has the right to request the concerned authority to extend the deadline for payment clearance. He has to explain his miseries which put pressure on him to pay back the amount completely. The company will take decision eventually. If it is settled, they will ask you to pay the amount later with higher interest rates. However it is adjustable in cool ambience.

Quick Payday Loans Online

Truly speaking, online visitors are interested to hit the sites with purposes of having the payday loans. Depending on the credit scores, successful payment clearance and economic strength, candidates are allowed to have repeated payday checks without any obligation. However, it is not a completely safe option to you. Though payday loans minimize your sudden trouble, finally you can be loser.

First of all, you have the headache to accelerate credit rating by making down payment. You can’t delay to pay as it will be disastrous with piles of interest rates. Few top money lending companies take hidden service charges based on the payday loan amount. So use the online calculators and then apply for the payday loan.

Important Things to Consider

- You should be a matured citizen

- Your age must be at least 18 years

- You should have bank account

- You must have permanent job with good credit score

Cons of Payday Loans

Risks hover to warn people. Have patience and go through cons of the payday loans. Interest rates are not low but high if you are desirous of selecting this quick advanced cash program during emergency.

Apart from this, companies will disturb you by imposing few unavoidable taxes and fees to pay eventually. In the event of the failure to satisfy companies due to the financial downtime, next time, it will be very problematic for the borrower to go for another payday loan. Reputation and social status can be affected in the matter of tussle with the money lender.

Secondly, when the money lender is not pleased owing to the interruption to collect fund from the borrowers, he can take drastic steps. These companies use the ultra modern credit checking tools. Maybe, they will try to decelerate the credit scores by submitting current documents and proofs against the customer. Credit crunch is undoubtedly harmful to people who have to maintain fairness in doing transactions.

More read: personal and Federal student loan

Conclusion

Payday loan is a good risk management tool to enable people to overcome hassle. However, one should not be whimsical when he or she is interested to go to any third party or financial company for having fast backup. You must go through guidelines, rules and methods of getting payday loans within a day. Improve your financial status by obtaining awe-inspiring payday loan. In this connection, it is much essential for you to read reviews, blogs and stat reports based on the availability of quick payday loans.

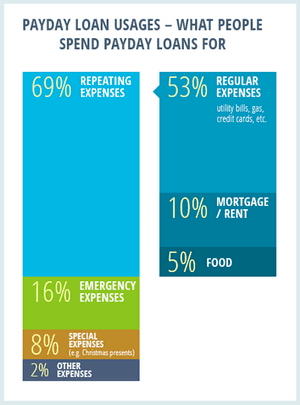

Stat report on payday loans

Online payday loans are flexible and dynamic. Your family members appreciate you because of the fast cash arrangement to keep prestige high. Simultaneously, steer clear of fictitious bad deals and ensure the smooth payday loan approval.